| UNITED STATES | ||||||||||||||||||||

| SECURITIES AND EXCHANGE COMMISSION | ||||||||||||||||||||

| Washington, D.C. 20549 | ||||||||||||||||||||

| SCHEDULE 14A INFORMATION | ||||||||||||||||||||

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 | ||||||||||||||||||||

| Filed by the Registrant | [ x ] | |||||||||||||||||||

| Filed by a | [ ] | |||||||||||||||||||

| Check the appropriate box: | ||||||||||||||||||||

| [ ] | Preliminary Proxy Statement | |||||||||||||||||||

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||||||||

| [ x ] | Definitive Proxy Statement | |||||||||||||||||||

| [ ] | Definitive Additional Materials | |||||||||||||||||||

| [ ] | Soliciting Material Under Rule 14a-12 | |||||||||||||||||||

| RENASANT CORPORATION | ||||||||||||||||||||

| (Name of Registrant as Specified in its Charter) | ||||||||||||||||||||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||||||||||||||||||

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||||||||

| [ x ] | No fee required. | |||||||||||||||||||

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||||||||

| Title of each class of securities to which transaction applies: | ||||||||||||||||||||

| Aggregate number of securities to which transaction applies: | ||||||||||||||||||||

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||||||||||||||

| Proposed maximum aggregate value of transaction: | ||||||||||||||||||||

| Total fee paid: | ||||||||||||||||||||

| [ ] | Fee paid previously with preliminary materials. | |||||||||||||||||||

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of filing. | |||||||||||||||||||

| Amount previously paid: | ||||||||||||||||||||

| Form, Schedule or Registration Statement No.: | ||||||||||||||||||||

| Filing Party: | ||||||||||||||||||||

| Date Filed: | ||||||||||||||||||||

| ITEMS OF BUSINESS | 1.Election of five Class 2 directors who will each serve a three-year term expiring in 2025; 2.Adoption, in a non-binding advisory vote, of a resolution approving the compensation of our named executive officers; 3.Ratification of the appointment of HORNE LLP as Renasant's independent registered public accountants for 2022; and 4.Transaction of such other business as may properly come before the annual meeting or any adjournments or postponements thereof. | ||||

| RECORD DATE | You can vote if you were a shareholder of record as of the close of business on February | ||||

| 18, 2022. | |||||

| ANNUAL REPORT | |||||

| HOW TO ACCESS THE VIRTUAL MEETING | You can access the webcast of the 2022 Annual Meeting over the internet at www.virtualshareholdermeeting.com/RNST2022. Detailed instructions for accessing the virtual meeting are | ||||

| PROXY VOTING | It is important that your shares be represented and voted at the annual meeting. You may vote your shares via a toll-free telephone number or on the | ||||

| TABLE OF CONTENTS | ||||||||||||||

| Page | ||||||

PROXY SUMMARY............................................................................................................................ | 1 | |||||

2 | ||||||

4 | ||||||

CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS | 6 | |||||

| Governing Documents and | ||||||

6 | ||||||

| Board of | ||||||

| Director Independence................................................................................................................. | 10 | |||||

| Board Leadership Structure.......................................................................................................... | 10 | |||||

| Board | 11 | |||||

| Role of the Board in Risk | 13 | |||||

| Director Selection and Diversity.................................................................................................... | 15 | |||||

16 | ||||||

| Legal Proceedings Involving a Director or Executive Officer and the Company or the | 17 | |||||

| Shareholder | 17 | |||||

BOARD MEMBERS AND COMPENSATION | 20 | |||||

| Members of the Board of | 20 | |||||

| Director | 25 | |||||

EXECUTIVE OFFICERS | 27 | |||||

COMPENSATION DISCUSSION AND ANALYSIS | 29 | |||||

29 | ||||||

29 | ||||||

| Compensation Committee | 31 | |||||

34 | ||||||

| 2021 Compensation Decisions..................................................................................................... | 36 | |||||

COMPENSATION COMMITTEE REPORT | 41 | |||||

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 41 | |||||

COMPENSATION TABLES | 42 | |||||

42 | ||||||

| Grants of Plan-Based | 44 | |||||

| Outstanding Equity Awards as of December | 45 | |||||

| Option Exercises and Vested Restricted | 45 | |||||

| Pension | 46 | |||||

| Non-Qualified Deferred | 46 | |||||

| CEO Pay | 47 | |||||

| Payments and Rights on Termination or Change in | 48 | |||||

54 | ||||||

INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS............................................................... | 55 | |||||

VOTING YOUR SHARES.................................................................................................................. | 56 | |||||

| Attending the Virtual Annual Meeting............................................................................................ | 56 | |||||

| Page | ||||||

| Record Date; Shares | 56 | |||||

56 | ||||||

57 | ||||||

| How Votes are | 57 | |||||

| Required Vote for Each | 57 | |||||

| Shares Held by the Renasant 401(k) | 57 | |||||

| Solicitation and Revocation of | 58 | |||||

PROPOSALS..................................................................................................................................... | 59 | |||||

| Proposal 1 - Election of | 59 | |||||

| Proposal 2 - Advisory Vote on Executive | 59 | |||||

| Proposal 3 - Ratification of the Appointment of HORNE LLP as Independent Registered Public Accountants for | ||||||

| Other Matters................................................................................................................................ | 60 | |||||

61 | ||||||

| Common Stock Ownership | 61 | |||||

| Beneficial Ownership of Common Stock by Directors and Executive | 62 | |||||

| Delinquent Section 16(a) | 64 | |||||

AVAILABILITY OF ANNUAL REPORT ON FORM 10-K.................................................................. | 64 | |||||

A-1 | ||||||

| PROXY SUMMARY | ||||||||||||||

| More Information | Board Recommendation | |||||||

| Proposal 1 | Page | FOR each nominee | ||||||

| Election of Class | ||||||||

| Proposal 2 | FOR | |||||||

| Proposal 3 | Page | FOR | ||||||

| Ratification of the appointment of HORNE LLP as our independent registered public accountants for | ||||||||

| Internet | Telephone | |||||||

| Visit www.proxyvote.com. You will need the control number on your Notice or the proxy card mailed to you, as applicable. | Call toll free (800) 690-6903. You will need the control number on the Notice or your proxy card, as applicable. | Complete and mail your proxy card to the address on the card, if you received a paper copy of the proxy statement and proxy card. | ||||||

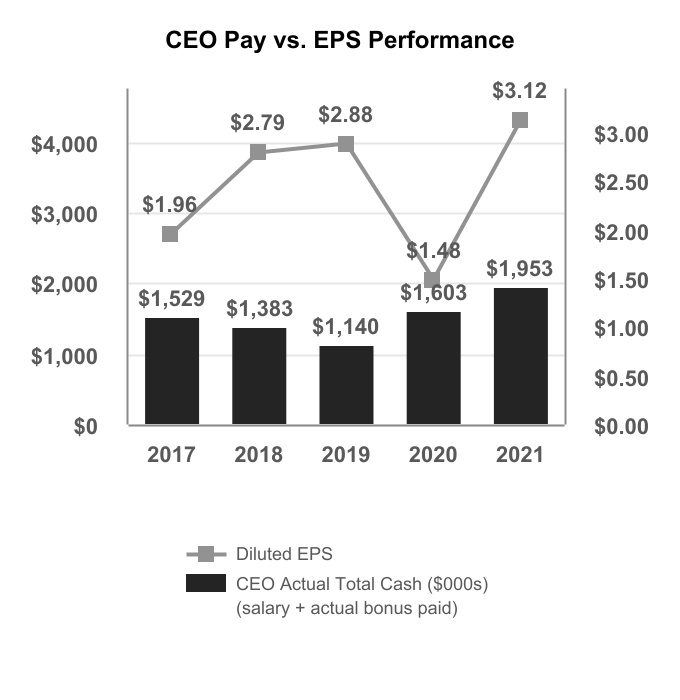

| Year Ended December 31, | |||||||||||||||||||||||||||||

| 2021 | 2020 | 2019 | 2018 | 2017 | |||||||||||||||||||||||||

| Diluted EPS (GAAP) | $3.12 | $1.48 | $2.88 | $2.79 | $1.96 | ||||||||||||||||||||||||

Adjusted Diluted EPS (non-GAAP)(1) | $2.98 | $1.93 | $3.03 | $3.00 | $2.42 | ||||||||||||||||||||||||

| Return on Average Shareholders’ Equity (GAAP) | 7.96 | % | 3.96 | % | 7.95 | % | 8.64 | % | 6.68 | % | |||||||||||||||||||

Adjusted Return on Average Tangible Shareholders' Equity (non-GAAP)(1) | 13.89 | % | 10.06 | % | 16.15 | % | 17.14 | % | 14.48 | % | |||||||||||||||||||

| Return on Average Assets (GAAP) | 1.11 | % | 0.58 | % | 1.30 | % | 1.32 | % | 0.97 | % | |||||||||||||||||||

Adjusted Return on Average Tangible Assets (non-GAAP)(1) | 1.16 | % | 0.85 | % | 1.54 | % | 1.58 | % | 1.32 | % | |||||||||||||||||||

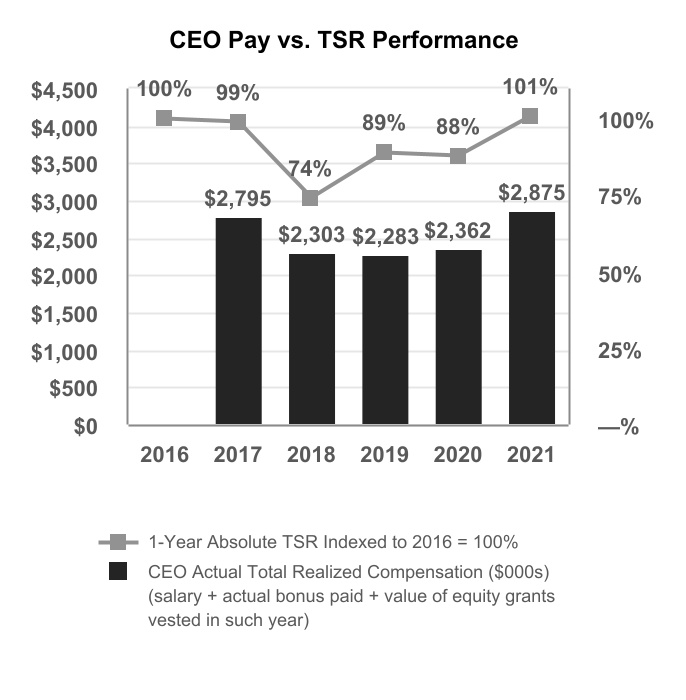

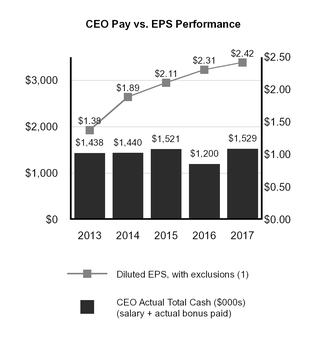

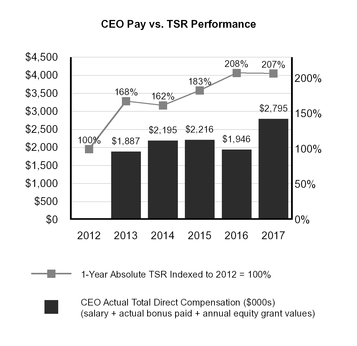

Correlation Measure | Comparative Compensation Measure | Correlation | ||||||

Diluted earnings per share (EPS)(1) | Total cash compensation, which includes base salary and an annual performance-based cash award | •EPS is an annual measure of earnings •Cash compensation represents payments with an annual focus | ||||||

| Total shareholder return (TSR) | Total realized compensation, which includes base salary and an annual cash award, which is performance-based, and the value of his equity compensation, a portion of which is performance-based | •TSR measures the delivery of shareholder value over a longer period •Total compensation, including equity compensation, includes payments that provide value over longer periods | ||||||

| Year Ended December 31, | ||||||||||||||

| 2017 | 2016 | 2015 | 2014 | 2013 | ||||||||||

Net Income, with exclusions(1) | $113,736 | $96,819 | $75,932 | $60,063 | $37,899 | |||||||||

Diluted EPS, with exclusions(1) | $2.42 | $2.31 | $2.11 | $1.89 | $1.38 | |||||||||

Return on Average Tangible Assets, with exclusions(1) | 1.32 | % | 1.28 | % | 1.23 | % | 1.16 | % | 0.89 | % | ||||

Return on Average Tangible Shareholders' Equity, with exclusions(1) | 14.48 | % | 16.23 | % | 16.10 | % | 16.37 | % | 12.17 | % | ||||

| Our Customers | •We developed a dedicated customer experience program – RNSTX. The program is designed to improve customer service, increase customer loyalty and promote customer advocacy. Customer evaluation is a core element of the RNSTX program, and in 2021 we conducted over 7,600 customer evaluations, which we used to increase the effectiveness of our customer service, including customer effort, satisfaction, overall experience and loyalty scores. In addition, 55% of our employees received perfect customer evaluations. •We provided customer engagement training to more than 50employees, including retail team leaders, branch managers and personal bankers equating to more than 1,000 classroom hours. | |||||

•Renasant Roots is a financial education resource that includes credit and home ownership education, small business technical assistance, youth mentoring, and charitable contributions. •We •We made loans through government sponsored programs totaling over $810 million, which have features attractive to low- and moderate-income borrowers. •We made over 655 Community Homebuyer Mortgage loans, totaling $120 million. These loans are intended to be attractive to borrowers in low- and moderate-income census tracts and contain terms and features to support applicants who may not otherwise qualify for our | |||||

| Our | •We implemented significant portions of the •We encouraged employee engagement and feedback through surveys such as | ||||

•Our employees completed over 78,000 hours (approximately 30 hours per employee) of training through our |

| CORPORATE GOVERNANCE AND THE BOARD OF DIRECTORS | ||||||||||||||

| Corporate Governance Guidelines | The Renasant Corporation Corporate Governance Guidelines (our “Governance Guidelines”) set forth principles that, together with our Articles of Incorporation, our Amended and Restated Bylaws, as amended (which we refer to as our “Bylaws”), committee charters and other policies, such as our Code of Business Conduct and Ethics, guide the board’s governance of Renasant. The Governance Guidelines address topics such as director qualifications, the board’s leadership structure, board responsibilities and the conduct of its operations, director education and other matters. | ||||

| Code of Ethics | We expect our directors, officers and employees to act with integrity and make decisions that are in our best interests and discourage situations that present a conflict between our interests and their personal interests. Under our Code of Business Conduct and Ethics (our “Code of Ethics”), our directors, officers and employees may not engage in any business or conduct, or enter into any contract or arrangement, that would give rise to an actual or potential conflict of interest without the prior approval of, for directors, the board or, as to officers and employees, their supervisor. We require our directors, officers and employees to annually certify that they have read and understand their obligations under the Code of Ethics. | ||||

| Committee Charters | The board has five standing committees: an executive committee, an audit committee, a compensation committee, an enterprise risk management committee (the “ERM committee”) and a nominating and corporate governance committee (the “nominating committee”). Each committee is governed by a written charter, which is annually reviewed and updated (as necessary). | ||||

| Majority Voting Policy | The board has adopted a “majority voting” policy for the election of directors. Under this policy, which applies only in uncontested elections, any nominee for director who receives a greater number of “withhold” votes for his or her election than votes “for” such election, although still elected to the board, must promptly tender his or her resignation as a director. This resignation will become effective upon acceptance by the board. If a resignation is tendered under these circumstances, the nominating committee will consider the resignation and recommend to the board whether to accept or reject the director’s resignation. No later than 90 days after the shareholders meeting that resulted in a director being required to submit his or her resignation, the board must consider the nominating committee’s recommendation and act on the director’s resignation. Both the nominating committee’s recommendation and the board’s decision with respect to a tendered resignation may include a range of alternatives, including acceptance of the resignation, rejection of it or rejection of it coupled with a commitment to address and cure the reasons believed to underlie the “withhold” votes. All relevant factors may be considered by the nominating committee and the board in evaluating whether to accept or reject a director’s resignation. These factors may include the reasons given by shareholders for the “withhold” vote, if known, and the impact on our compliance with SEC regulations and Nasdaq listing rules if the director were to no longer serve on the board and the committees on which he or she serves. The director at issue may not participate in the committee’s and the board’s deliberations. The board’s decision will be disclosed in a Current Report on Form 8-K furnished to the SEC promptly after the board arrives at a decision regarding whether to accept or reject the director’s resignation (with the reason(s) for rejecting the resignation, if applicable). | ||||

| Stock Ownership Guidelines | The board has adopted written stock ownership guidelines applicable to our directors and executive officers. More details about how the guidelines apply to our executives can be found under the heading “Compensation Committee Practices” in the Compensation Discussion and Analysis section below. For our non-employee directors, the stock ownership guidelines require each director to maintain a meaningful investment in Renasant common stock, which we believe demonstrates a commitment to increasing the long-term value of our stock and aligns the financial interests of our directors with those of our shareholders. Under the guidelines, within the first year of becoming a non-employee director, a director must own at least 500 shares of common stock, and within five years of becoming a director, each non-employee director must own stock with a value equal to at least three times the annual cash retainer. The value of a director’s Renasant stock is determined as of January 1 each year, using the average closing market price of our stock for the 20 trading day period ending on the last day of the prior year. Shares that a director has pledged do not count toward a director’s required minimum ownership levels. Based on an annual cash retainer of $60,000 (the retainer in effect on January 1, 2022), the guidelines require directors with at least five years of service to own Renasant common stock with a value of at least $180,000. The average closing price of our stock for the 20 trading days ending December 31, 2021 was $37.12, and based on that price all of our directors own at least approximately $195,000 of our common stock (and most own substantially more), except for Gary D. Butler. Because Mr. Butler only joined the board in April 2020, he still has a number of years to achieve his required stock ownership. | ||||

| Insider Trading Policy | The board has adopted a policy designed to prevent insider trading of our securities. The policy prohibits our directors, officers and employees, their immediate family members and entities that they control from purchasing or selling our securities while in possession of material nonpublic information and from disclosing material nonpublic information to third parties. “Material nonpublic information” includes matters such as our earnings results, changes in senior management and merger and acquisition activity. Significant cybersecurity incidents and disruptions to our information technology infrastructure, among other events, are also deemed material nonpublic information. Two additional trading restrictions apply to our directors, senior executive officers and certain other individuals, such as senior accounting staff (all of whom we refer to as “covered persons”): •A covered person may trade in our securities only during a “trading window” (and provided that he or she is not otherwise in possession of material nonpublic information); the window opens two trading days after our quarterly earnings release and closes early in the last month of each quarter. •A covered person may not trade in our securities, even during an open trading window, unless a committee made up of our chief operating officer, our chief accounting officer and our general counsel approves, or “pre-clears,” the transaction in advance. Pre-clearance provides the opportunity to evaluate a proposed trade and independently decide whether the covered person possesses material nonpublic information. Our directors, officers and employees must annually certify that they have reviewed our insider trading policy and understand their obligations under the policy. | ||||

| Hedging and Pledging Policy | Renasant maintains a Policy on Hedging or Pledging Company Stock (our “Hedging Policy”). A primary goal of our compensation program and our stock ownership requirements is to align the economic interests of our directors and executive officers with those of our shareholders. We believe that allowing a director or employee to hedge the economic risk of owning our stock undermines the intended economic alignment. The Hedging Policy prohibits our directors, officers, employees and their respective “designees” (explained below) from entering into a transaction that has the effect of hedging the economic risks associated with the ownership of our common stock. Specifically, our directors, officers and employees and their designees are prohibited from engaging in any of the following activities: •Purchasing any financial instrument (including prepaid variable forward contracts, equity swaps, collars, exchange funds, puts, calls and similar derivative instruments) or otherwise engaging in any transaction that hedges or offsets, or is designed to hedge or offset, any decrease in the market value of Renasant securities granted as compensation to, or held, directly or indirectly, by the director, officer or employee; or •Engaging in short sale transactions in Renasant securities. A person is a “designee” of a director, officer or employee for purposes of the Hedging Policy if, under the facts and circumstances, the person has been appointed to make decisions that such director, officer or employee should reasonably believe would result in hedging/offsetting prohibited by the Hedging Policy. Although the Hedging Policy does not prohibit pledging of our common stock, we discourage the practice, and any stock that a director or executive officer pledges cannot be used to satisfy our stock ownership guidelines. Our directors, officers and employees must annually certify that they have reviewed our Hedging Policy and understand the restrictions under the policy. For more information about our directors and named executive officers who have pledged shares of Renasant stock, refer to the Stock Ownership section below under the heading “Beneficial Ownership of Common Stock by Directors and Executive Officers.” | ||||

| Review and Approval of Related Person Transactions | The board is responsible for reviewing and approving or ratifying all material transactions between us or our subsidiaries and any of our directors or executive officers, their immediate family members and businesses with which they are associated, all referred to as “related persons.” Other than our Code of Ethics, our related person transaction policy is not in writing, although we have adopted written policies to comply with regulatory requirements and restrictions applicable to us, including Sections 23A and 23B of the Federal Reserve Act and Regulation W promulgated thereunder (which govern certain transactions by the Bank with its affiliates) and the Federal Reserve’s Regulation O (which governs loans and other extensions of credit by the Bank to its executive officers, directors and principal shareholders). Additional information about the process used by the board to identify related person transactions and the transactions that the board has reviewed and approved may be found below under the heading “Related Person Transactions.” | ||||

| Class 1 | Class 2 | Class 3 | ||||||

| Donald Clark, Jr. | John M. Creekmore | Gary D. Butler | ||||||

| Albert J. Dale, III | Jill V. Deer | John T. Foy | ||||||

| Connie L. Engel | Neal A. Holland, Jr. | Richard L. Heyer, Jr. | ||||||

| C. Mitchell Waycaster | E. Robinson McGraw | Michael D. Shmerling | ||||||

| Sean M. Suggs | ||||||||

| Executive Committee | |||||

| John M. Creekmore, Chair | The executive committee exercises the power and authority of the full board of directors between scheduled board meetings. Among other things, the executive committee takes a lead role in overseeing the preparation of our annual budget and succession planning for our senior management. The ability of the executive committee to act is subject to limitations imposed under Mississippi law and the committee’s charter. The executive committee is composed of the chairman of the board, the lead director, the chief executive officer and three additional directors who are “independent directors” as defined in the Nasdaq Listing Rules. The executive committee met 22 times in 2021. | ||||

| Neal A. Holland, Jr., Vice-Chair | |||||

| Albert J. Dale, III | |||||

| John T. Foy | |||||

| E. Robinson McGraw | |||||

| C. Mitchell Waycaster | |||||

| Audit Committee | |||||||||

| John T. Foy, Chair | The audit committee's responsibilities include the following: | ||||||||

| Appointing, | |||||||||

| Monitoring the integrity of our financial reporting process and system of internal controls; | |||||||||

| Michael D. Shmerling | |||||||||

| Monitoring the independence and performance of our independent registered public accountants and internal auditing department; | |||||||||

| Pre-approving all auditing and permitted non-audit services provided by our independent registered public accountants; | |||||||||

| Facilitating communication among our independent registered public accountants, management, the internal auditing department and the board of directors; and | |||||||||

| Establishing procedures for (1) the receipt, retention and treatment of complaints we receive regarding accounting, internal accounting controls or auditing matters and (2) the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters. | |||||||||

The sections below titled | |||||||||

| Each member of our audit committee is an “independent director” within the meaning of the Nasdaq Listing Rules, satisfies the other requirements for audit committee membership under the Nasdaq Listing Rules and meets all independence requirements under | |||||||||

| Nominating and Corporate Governance Committee | |||||

| Neal A. Holland, Jr., Chair | The nominating committee evaluates, nominates and recommends individuals for membership on our board of directors and the Each member of the nominating committee is an “independent director” under the Nasdaq Listing Rules. | ||||

| John M. Creekmore, Vice-Chair | |||||

| John T. Foy | |||||

| Michael D. Shmerling | |||||

| Compensation Committee | |||||

| Albert J. Dale, III, Chair | The compensation committee’s primary functions are setting our overall compensation strategy and administering the compensation of our named executive officers and other senior executive officers. The Each member of the committee is an “independent director” within the meaning of the Nasdaq Listing Rules and a “non-employee director” under SEC regulations. In determining independence, the board considered each member’s ability to be independent from management | ||||

| Richard L. Heyer, Jr., Vice-Chair | |||||

| Donald Clark, Jr. | |||||

| John M. Creekmore | |||||

| Neal A. Holland, Jr. | |||||

| Enterprise Risk Management | |||||

| Michael D. Shmerling, Chair | The ERM committee has overall responsibility for our enterprise-wide risk assessment, management and oversight process. To ensure that the committee has insight into our overall operations, the chairs of our executive, audit, compensation and nominating committees and the Bank’s credit review and technology committees are members of the ERM committee. More information about the Company’s risk assessment process and the role of the ERM committee in this process may be found below under the heading Each member of the ERM committee is an “independent director” as defined under the Nasdaq Listing Rules. | ||||

| Gary D. Butler | |||||

| John M. Creekmore | |||||

| Albert J. Dale, III | |||||

| Richard L. Heyer, Jr. | |||||

| Neal A. Holland, Jr. | |||||

| Board Diversity Matrix (As of March 14, 2022) | ||||||||||||||

| Total Number of Directors | 13 | |||||||||||||

| Female | Male | Non-Binary | Did Not Disclose Gender | |||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 2 | 11 | 0 | 0 | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | 0 | 1 | 0 | n/a | ||||||||||

| Alaskan Native or Native American | 0 | 0 | 0 | n/a | ||||||||||

| Asian | 0 | 0 | 0 | n/a | ||||||||||

| Hispanic or Latinx | 0 | 0 | 0 | n/a | ||||||||||

| Native Hawaiian or Pacific Islander | 0 | 0 | 0 | n/a | ||||||||||

| White | 2 | 10 | 0 | n/a | ||||||||||

| Two or More Races or Ethnicities | 0 | 0 | 0 | n/a | ||||||||||

| LGBTQ+ | 0 | |||||||||||||

| Did Not Disclose Demographic Background | 0 | |||||||||||||

| BOARD MEMBERS AND COMPENSATION | ||||||||||||||

| Name | Age | Class | Background, Qualifications and Skills | Name | Age | Class | Background, Experience, Qualifications and Skills | |||||||

Donald Clark, Jr. Director since 2017 | 68 | 1 | Background: Mr. Clark currently serves as Chairman of Butler Snow, LLP, the largest Mississippi-based law firm. As a member of the firm’s Public Finance and Incentives Group, Mr. Clark has extensive experience in municipal bonds, economic development incentives and government relations. Mr. Clark was appointed as a director of the Company upon the completion of our acquisition of Metropolitan in July 2017. Experience/Qualifications/Skills: Mr. Clark is highly regarded in the legal profession. As Chairman of Butler Snow, he oversees the operations of a firm with over 340 attorneys located in 22 offices spread throughout the United States (as well as two international offices), many of which are located within the Bank’s footprint. This experience provides the board with insight on the needs of customers within many of our markets. As the leader of a law firm, Mr. Clark also can provide valuable input to the board on enterprise-wide risk management practices. Finally, Mr. Clark’s experience in public finance, economic development incentives and government relations makes him a resource to the board in these areas. | Donald Clark, Jr. Director since 2017 | 72 | 1 | Background: Mr. Clark is senior counsel in Butler Snow, LLP, the largest law firm based in the State of Mississippi. He served as chairman of the firm for 14 years, ending in December 2019. As a member of the firm’s Public Finance and Incentives Group, Mr. Clark has extensive experience in municipal bonds, economic development incentives and government relations. Mr. Clark was appointed a director of the Company upon the completion of our acquisition of Metropolitan BancGroup, Inc. in July 2017. Experience/Qualifications/Skills: Mr. Clark is highly regarded in the legal profession. As Chairman of Butler Snow, he oversaw the operations of a firm with over 350 attorneys located in 26 offices spread throughout the United States (as well as two international offices), many of which are located within the Bank’s footprint. His experience provides the board with insight on the needs of customers within many of our markets. As the former leader of a law firm, Mr. Clark also can provide valuable input to the board on enterprise-wide risk management practices. Finally, Mr. Clark’s experience in public finance, economic development incentives and government relations makes him a resource to the board in these areas. | |||||||

Albert J. Dale, III Director since 2007 | 67 | 1 | Background: Mr. Dale has served as president of Dale, Inc. since 1985. Dale, Inc., located in Nashville, Tennessee, is a specialty contractor and a Marvin Windows and Doors, Kolbe Windows and Doors and Sierra Pacific Windows and Doors dealer in Tennessee, Kentucky and Alabama. He was appointed as a director of the Company upon the completion of our acquisition of Capital Bancorp, Inc., or Capital, in July 2007. Experience/Qualifications/Skills: As a supplier to businesses and consumers, Mr. Dale’s professional experience provides the board with insight from the customer’s perspective on the needs and risks associated with business development. In addition, Mr. Dale brings to the board an intimate knowledge of Nashville, Tennessee, one of our growth markets. We rely on Mr. Dale for advice on where and how to serve the Nashville metropolitan area. | Albert J. Dale, III Director since 2007 | 71 | 1 | Background: Mr. Dale is chairman of the board of Dale, Inc. and served as president of the Company from 1985 until December 2018. Dale, Inc., located in Nashville, Tennessee, is a specialty contractor and a Marvin Windows and Doors, Kolbe Windows and Doors and Sierra Pacific Windows and Doors dealer in Tennessee, Kentucky and Alabama. He was appointed a director of the Company upon the completion of our acquisition of Capital Bancorp, Inc., or "Capital," in July 2007. Experience/Qualifications/Skills: As a supplier to businesses and consumers, Mr. Dale’s professional experience provides the board with insight from the customer’s perspective on the needs and risks associated with business development. In addition, Mr. Dale brings to the board an intimate knowledge of Nashville, Tennessee, one of our growth markets. We rely on Mr. Dale for advice on where and how to serve the Nashville metropolitan area. | |||||||

| Name | Age | Class | Background, Experience, Qualifications and Skills | ||||||||

Connie L. Engel Director since 2018 | 69 | 1 | Background: Ms. Engel is a partner in the Atlanta Office Division of Childress Klein, Inc., a commercial real estate firm engaged in the development, management and leasing of commercial real estate throughout the southeastern United States. Ms. Engel oversees Childress Klein’s Senior Living and Brokerage divisions in Atlanta, Georgia. Since 2005, Ms. Engel has served on the Board of Trustees of the Kennesaw State University Foundation, Kennesaw, Georgia, as Chairwoman and trustee. She is the Vice Chair of the Cumberland Community Improvement District and currently serves on the Board of Directors of the Cobb Marietta Convention and Exhibit Hall Authority. Experience/Qualifications/Skills: Commercial real estate lending is a significant aspect of our operations. Ms. Engel's extensive experience in commercial real estate development enables her to provide valuable insight with respect to our commercial real estate operations throughout our footprint, but particularly in the Atlanta metropolitan area, one of our most important growth markets. In addition, Ms. Engel served on the audit committee of Brand Group Holdings, Inc. prior to our acquisition of the company in September 2018. We believe this experience allows her to be a valuable member of our audit committee. | ||||||||

C. Mitchell Waycaster Director since 2018 | 63 | 1 | Background: Mr. Waycaster has served as our and the Bank’s Chief Executive Officer since May 1, 2018, and he has been President of the Company and the Bank since January 2016. Prior to assuming his current position, Mr. Waycaster was our Chief Operating Officer since January 2016. Prior to being named President, Mr. Waycaster was our Executive Vice President since February 2003 and a Senior Executive Vice President since June 2005. He served as Chief Administrative Officer of the Bank from April 2007 to January 2016. Mr. Waycaster served as President of the Mississippi Division of Renasant Bank from January 2005 to April 2007; previously Mr. Waycaster served as Executive Vice President and Director of Retail Banking of the Bank from 2000 until December 2004. Experience/Qualifications/Skills: Mr. Waycaster has been an employee of the Bank for over 40 years. During that time, he has worked in virtually all of the Bank’s areas of operation. This experience gives Mr. Waycaster a detailed understanding of our operations as well as the opportunities and challenges that we face. It is unlikely that any other Renasant employee has a better understanding of our current operations and our future strategies than Mr. Waycaster. His insights are essential to assisting the board in developing and implementing our strategic plans. | ||||||||

John M. Creekmore Director since 1997 | 66 | 2 | Background: Mr. Creekmore is a consultant to United Furniture Industries, Inc., where he served as general counsel from July 2017 until July 2021. Prior to becoming general counsel of United Furniture, Mr. Creekmore was the owner of the Creekmore Law Office, PLLC. Experience/Qualifications/Skills: As the former general counsel of a large manufacturing enterprise, Mr. Creekmore brings a legal point of view to the risks and challenges that we face. Mr. Creekmore has served on our board and the Bank's board since 1997, providing insights regarding the legal implications of our plans and strategies as well as internal operational matters. Finally, Mr. Creekmore works in Verona, Mississippi, and helps shape our policies with respect to our smaller markets. | ||||||||

| Name | Age | Class | Background, Qualifications and Skills |

John T. Foy Director since 2004 | 70 | 1 | Background: Mr. Foy is retired. From February 2004 until February 2008, he served as president and chief operating officer of Furniture Brands International, Inc. During that time, he was also a member of the board of directors of Furniture Brands International. Prior to 2004 he served as president and chief executive officer of Lane Furniture Industries. Furniture Brands International was, and Lane Furniture Industries is, engaged in the manufacture of upholstered and wooden furniture. Experience/Qualifications/Skills: Furniture manufacturing represents a major segment of the economy in our North Mississippi markets. We believe that Mr. Foy’s broad experience in the furniture manufacturing industry gives us an advantage in soliciting these types of customers, as well as customers in the manufacturing industry in general. Also, Mr. Foy’s experience as the president and a director of Furniture Brands International, Inc., which was a publicly-traded company during Mr. Foy’s tenure, provides him with insights on the operation of a company with diverse operations as well as on corporate governance. |

C. Mitchell Waycaster Nominee for election | 59 | 1 | Background: Mr. Waycaster has served as our President and Chief Operating Officer since January 2016; and he will assume the role of Chief Executive Officer as of May 1, 2018. Prior to being President, Mr. Waycaster served as our Executive Vice President since February 2003 and a Senior Executive Vice President since June 2005. He served as Chief Administrative Officer of the Bank from April 2007 to January 2016. Mr. Waycaster served as President of the Mississippi Division of Renasant Bank from January 2005 to April 2007; previously Mr. Waycaster served as Executive Vice President and Director of Retail Banking of the Bank from 2000 until December 2004. Experience/Qualifications/Skills: Mr. Waycaster has been an employee of the Bank for over 38 years. During that time, he has worked in virtually all of the Bank's areas of operation. This experience gives Mr. Waycaster a detailed understanding of our operations as well as the opportunities and challenges that we face. As our next chief executive officer, Mr. Waycaster's insight will be essential to assisting the board in developing and implementing our strategic plans. |

John M. Creekmore Director since 1997 | 62 | 2 | Background: Since June 2017, Mr. Creekmore has served as general counsel for United Furniture Industries, Inc. Prior to taking this position, Mr. Creekmore was the owner of the Creekmore Law Office, PLLC. Experience/Qualifications/Skills: As general counsel of a large manufacturing enterprise, Mr. Creekmore brings a legal point of view to the risks and challenges that we face. He also provides us with insights regarding the legal implications of our plans and strategies. Finally, Mr. Creekmore works in Verona, Mississippi, and helps shape our policies with respect to our smaller markets. |

| Name | Age | Class | Background, Experience, Qualifications and Skills | ||||||||

Jill V. Deer Director since 2010 | 59 | 2 | Background: Ms. Deer is Chief Administrative Officer for Brasfield & Gorrie, L.L.C., one of the nation’s largest privately-held construction firms, and a member of the company's executive team. In her role as Chief Administrative Officer, Ms. Deer is responsible for strategic planning and leads, among other areas, Brasfield & Gorrie's human resources, legal, insurance and risk, and corporate responsibility groups. Prior to joining Brasfield & Gorrie in 2014, Ms. Deer served as a principal of Bayer Properties, L.L.C., a full service real estate company based in Birmingham, Alabama, that owns, develops and manages commercial real estate. Ms. Deer joined Bayer Properties in 1999 to serve as an executive officer and general counsel of the company. Prior to that time, she was a partner in a large regional law firm in Birmingham practicing in the area of commercial real estate finance. Experience/Qualifications/Skills: The Birmingham metropolitan area is the largest metropolitan area in Alabama and one of our key growth markets. Ms. Deer’s knowledge and experience in this market helps us develop strategies to further expand our presence in Birmingham. Furthermore, Ms. Deer’s professional experience in the real estate and construction industries gives the board an additional resource in understanding the risks and trends associated with commercial real estate, especially because Brasfield & Gorrie operates in many of the same markets in which Renasant is located. Finally, her experience in strategic planning assists the board in oversight of the formulation and implementation of our strategic plans, including with respect to our corporate social responsibility efforts. | ||||||||

Neal A. Holland, Jr. Director since 2005 | 66 | 2 | Background: Mr. Holland has been president of Holland Company, Inc., a diversified sand, stone and trucking company in Decatur, Alabama, since 1980. He is also the chairman and CEO of Alliance Sand and Aggregates, LLC and the owner of Miracle Mountain Ranch LLC. Mr. Holland was appointed a director of the Company upon the completion of our acquisition of Heritage Financial Holding Corporation in 2005. Experience/Qualifications/Skills: Mr. Holland gives us valuable advice in shaping our policies and strategies in our Alabama markets. Mr. Holland’s service on the board and executive committee of Heritage Financial Holding Corporation, which we acquired in 2005, has given him added experience and insight to the risks associated with serving on the board of a publicly-traded financial institution. As the owner of multiple businesses, he also is able to add a customer’s perspective to the board’s discussions. | ||||||||

E. Robinson McGraw Director since 2000 | 75 | 2 | Background: Since May 1, 2018, Mr. McGraw has been Executive Chairman of the Company and the Bank. Prior to assuming this position, he served as our and the Bank’s Chief Executive Officer since 2000, and he served as our and the Bank’s President from 2000 to January 2016. Since June 2005, Mr. McGraw has served as Chairman of our and the Bank’s board of directors. Mr. McGraw served as Executive Vice President and General Counsel of the Bank prior to becoming Chief Executive Officer. Experience/Qualifications/Skills: It is unlikely that there is any individual that has a more intimate knowledge of our history than Mr. McGraw, and his understanding of our current operations and our future plans is likely exceeded only by Mr. Waycaster's. His insight is an essential part of formulating our plans and strategies. Mr. McGraw’s legal background and years of experience with the Company provide the board an additional resource on legal implications and the regulatory requirements specifically attributable to the banking industry and financial institutions. | ||||||||

| Name | Age | Class | Background, Qualifications and Skills |

Jill V. Deer Director since 2010 | 55 | 2 | Background: Ms. Deer is Vice President of Planning, Administration and Risk for Brasfield & Gorrie, L.L.C., one of the nation’s largest privately-held construction firms, with revenues in excess of $3 billion. Prior to joining Brasfield & Gorrie, Ms. Deer served as a principal of Bayer Properties, L.L.C., a full service real estate company based in Birmingham, Alabama that owns, develops and manages commercial real estate. Ms. Deer joined Bayer Properties in 1999 to serve as an executive officer and general counsel of the company. Prior to that time, she was a partner in a large regional law firm in Birmingham practicing in the area of commercial real estate finance. Experience/Qualifications/Skills: The Birmingham metropolitan area is the largest metropolitan area in Alabama and one of our key growth markets. Ms. Deer’s knowledge and experience in this market helps us develop strategies to further expand our presence in Birmingham. Furthermore, Ms. Deer’s professional experience in the real estate and construction industries gives the board an additional resource in understanding the risks and trends associated with commercial real estate, especially because Brasfield & Gorrie operates in many of the same markets in which Renasant is located. |

Neal A. Holland, Jr. Director since 2005 | 62 | 2 | Background: Mr. Holland has been president of Holland Company, Inc., a diversified sand, stone and trucking company in Decatur, Alabama, since 1980. He is also the chairman and CEO of Alliance Sand and Aggregates, LLC. Mr. Holland was appointed as a director of the Company upon the completion of our acquisition of Heritage Financial Holding Corporation in 2005. Mr. Holland is also the owner of Miracle Mountain Ranch LLC, a summer camp and retreat center located in Pennsylvania. Experience/Qualifications/Skills: Mr. Holland gives us valuable advice in shaping our policies and strategies in our Alabama markets. Mr. Holland’s service on the board and executive committee of Heritage Financial Holding Corporation, which we acquired in 2005, has given him added experience and insight to the risks associated with serving on the board of a publicly-traded financial institution. As the owner of multiple businesses, he also is able to add a borrower’s perspective to the board’s discussions. |

E. Robinson McGraw Director since 2000 | 71 | 2 | Background: Mr. McGraw has served as our and the Bank’s Chief Executive Officer since 2000, and he served as our and the Bank’s President from 2000 to January 2016. Effective May 1, 2018, Mr. McGraw will transition from Chief Executive Officer to Executive Chairman of the Company and the Bank. Since June 2005, Mr. McGraw has also served as Chairman of our and the Bank’s board of directors, and he will continue to serve in these capacities after his transition to Executive Chairman. Mr. McGraw served as Executive Vice President and General Counsel of the Bank prior to becoming our Chief Executive Officer. Experience/Qualifications/Skills: It is unlikely that there is any individual that has a more intimate knowledge of our history, our current operations and our future plans than Mr. McGraw. His insight is an essential part of formulating our plans and strategies. Mr. McGraw’s legal background and years of experience with the Company provide the board an additional resource on legal implications and the regulatory requirements specifically attributable to the banking industry and financial institutions. |

| Name | Age | Class | Background, Experience, Qualifications and Skills | ||||||||

Sean M. Suggs Director since 2018 | 56 | 2 | Background: Mr. Suggs is the Vice President, Social Innovation, for Toyota Motor North America. In this position, Mr. Suggs is responsible for, among other things, Toyota Motor North America's philanthropy efforts, diversity and inclusion strategy and environmental sustainability function across North America. Prior to assuming this position in January 2021, Mr. Suggs was the president of Toyota Motor Manufacturing, Mississippi, Inc., beginning in January 2018. In this role, he was responsible for all manufacturing and all accounting, financial reporting and other administrative functions of Toyota’s Blue Springs, Mississippi, plant, which produces the Toyota Corolla. Prior to this position, Mr. Suggs was vice president of manufacturing and administration at the Mississippi vehicle assembly plant. Prior to joining the automotive industry in 2008, Mr. Suggs served eight years in the United States Army. Experience/Qualifications/Skills: Given his position overseeing the diversity, inclusion and sustainability efforts of an entity spanning the entire North American continent, Mr. Suggs provides the board essential insight on our own efforts to promote diversity and inclusion at the Company and enhance the sustainability of our operations. Furthermore, prior to his current role, Mr. Suggs oversaw the operations of an automobile manufacturing plant. The successful management of such an operation requires expertise in manufacturing technology, production quality and corporate leadership, among other things. The skills that Mr. Suggs acquired in overseeing manufacturing operations at Toyota’s plant in Mississippi enhance the board’s oversight of the Bank’s operations. | ||||||||

Gary D. Butler, Ph.D. Director since 2020 | 51 | 3 | Background: Dr. Butler is the founder, chairman and chief executive officer of Camgian Microsystems Corporation, a recognized leader in developing advanced information technologies that leverage innovations in the areas of signal processing, data analytics and artificial intelligence. Dr. Butler also serves on the Vanderbilt University School of Engineering Board of Visitors. He has served as a director of the Bank since April 2019. Experience/Qualifications/Skills: Dr. Butler leads a company on the cutting-edge of developing advanced information processing technologies that deliver decision support capabilities in the national security and finance sectors. His background in algorithms and artificial intelligence are invaluable to us as we develop strategies to leverage data collected in our daily operations. Also, Dr. Butler's expertise in internet and wireless communication-related matters enhance our board's ability to oversee and advise on our strategies with respect to information technology, business continuity planning and cybersecurity. Finally, in addition to its organic growth, Camgian's growth has been supported by acquisition. We believe that Dr. Butler's experience in this regard enables him to provide valuable insights with respect to the opportunities and risks associated with our mergers and acquisitions activity. | ||||||||

| Name | Age | Class | Background, Qualifications and Skills |

Marshall H. Dickerson Director since 1996 | 69 | 3 | Background: Mr. Dickerson is retired. Prior to his retirement, he was the owner and manager of Dickerson Furniture Company, a company engaged in retail home furnishings sales until its closing in 2012. Experience/Qualifications/Skills: Mr. Dickerson owned and operated his own business for over 33 years. As a former small business owner, he understands the capital needs and other challenges that many of our small business customers face on a daily basis; he also understands the services that a small business owner requires from its banking relationship. We believe that Mr. Dickerson’s insights on these topics help us tailor our products, as well as our customer service operations, to meet the needs of this important segment of our business. |

R. Rick Hart Director since 2007 | 69 | 3 | Background: Mr. Hart has served as an Executive Vice President of the Company and President of the Northern Region of the Bank since October 2012. Effective as of the annual meeting, Mr. Hart will transition to the position of the Chairman of the Middle Tennessee Division. He served as the President of the Tennessee Division and Middle Tennessee Division of the Bank from July 2007 until October 2012. Prior to our acquisition of Capital, Mr. Hart served as chairman, president and chief executive officer of Capital Bank & Trust Company, in Nashville, Tennessee. Mr. Hart was appointed as a director of the Company upon the completion of our acquisition of Capital in July 2007. Experience/Qualifications/Skills: Mr. Hart brings the experience of a Nashville banker to the board, helping to formulate our plans for the Nashville market. Along with Mr. McGraw, Mr. Hart serves as a liaison between the board and our employees, keeping the board abreast of employee concerns and morale. |

Richard L. Heyer, Jr. Director since 2002 | 61 | 3 | Background: Dr. Heyer has served as a physician and partner of Tupelo Anesthesia Group, P.A. since 1989. In addition, Dr. Heyer is President and co-owner of TAG Billing, LLC, a medical billing service provider in the medical industry. Experience/Qualifications/Skills: Dr. Heyer’s experience in the medical industry brings a unique perspective to the challenges and opportunities that our board faces. Dr. Heyer’s background and experience is important in the formulation of board policy. Dr. Heyer is a business owner in the medical industry and adds this perspective to board discussions. |

J. Niles McNeel Director since 1999 | 71 | 3 | Background: Mr. McNeel has engaged in the practice of law as a partner of the law firm of McNeel and Ballard since 1983. Experience/Qualifications/Skills: Mr. McNeel’s practice is based in Louisville, Mississippi, giving him insight into the issues facing our customers in our smaller markets. As an attorney, Mr. McNeel also brings a legal perspective to the board’s deliberations and analysis. |

| Name | Age | Class | Background, Experience, Qualifications and Skills | ||||||||

John T. Foy Director since 2004 | 74 | 3 | Background: Mr. Foy is retired. From February 2004 until February 2008, he served as president and chief operating officer of Furniture Brands International, Inc. During that time, he was also a member of the board of directors of Furniture Brands International. Prior to 2004, Mr. Foy served as president and chief executive officer of Lane Furniture Industries. Furniture Brands International was, and Lane Furniture Industries is, engaged in the manufacture of upholstered and wooden furniture. Experience/Qualifications/Skills: Furniture manufacturing is a major segment of the economy in our North Mississippi markets. We believe that Mr. Foy’s broad experience in the furniture manufacturing industry gives us an advantage in soliciting these types of customers, as well as customers in the manufacturing industry in general. Also, Mr. Foy’s experience as the president and a director of Furniture Brands International, Inc., which was a publicly-traded company during Mr. Foy’s tenure, provides him with insights on the operation of a company with diverse operations as well as on corporate governance. | ||||||||

Richard L. Heyer, Jr. Director since 2002 | 65 | 3 | Background: Dr. Heyer has been a physician and employee of Tupelo Anesthesia Group, P.A. since 1989, where he was formerly a partner. In addition, Dr. Heyer is President and co-owner of TAG Billing, LLC, a medical billing service provider in the medical industry. Experience/Qualifications/Skills: Dr. Heyer’s experience in the medical industry brings a unique perspective to the challenges and opportunities that our board faces. Dr. Heyer’s background and experience is important in the formulation of board policy. Dr. Heyer is a business owner in the medical industry and adds this perspective to board discussions. | ||||||||

Michael D. Shmerling Director since 2007 | 66 | 3 | Background: Mr. Shmerling has served as chairman of Choice Food Group, Inc., a manufacturer and distributor of food products, since July 2007 and chairman of Clearbrook Holdings Corp. (formerly XMI Holdings Inc.) since 1999. Mr. Shmerling previously served as a senior advisor to Kroll, Inc., a risk consulting company, from August 2005 to June 2007 and an executive vice president of Kroll, Inc. from August 2000 to June 2005. Effective as of May 2001, he also served as Chief Operating Officer of Kroll. Mr. Shmerling was appointed a director of the Company upon the completion of our acquisition of Capital in July 2007. Mr. Shmerling is also a director for Healthstream, Inc., a publicly-traded company, and serves as chairman of the company's audit committee. Experience/Qualifications/Skills: Mr. Shmerling’s business and philanthropic endeavors in the Nashville market provide us with opportunities to create new business relationships and grow market share in this key area. In addition, his 44-year professional history as a licensed CPA (now inactive) in public and private practice provides the board with a broad range of financial knowledge and business acumen. Mr. Shmerling is experienced in assessing and mitigating risk and formulating policies designed to minimize risk exposure. In addition, his experience as an officer and director of publicly-traded companies gives the board another resource for issues specific to publicly-traded companies in the areas of financial reporting and corporate governance. | ||||||||

| Name | Age | Class | Background, Qualifications and Skills |

Michael D. Shmerling Director since 2007 | 62 | 3 | Background: Mr. Shmerling has served as chairman of Choice Food Group, Inc., a manufacturer and distributor of food products, since July 2007 and chairman of Clearbrook Holdings Corp. (formerly XMI Holdings Inc.) since 1999. Mr. Shmerling previously served as a senior advisor to Kroll, Inc., a risk consulting company, from August 2005 to June 2007 and an executive vice president of Kroll, Inc. from August 2000 to June 2005. Effective as of May 2001, he also served as Chief Operating Officer of Kroll. Mr. Shmerling was appointed as a director of the Company upon the completion of our acquisition of Capital in July 2007. Mr. Shmerling is also a director for Healthstream, Inc., a publicly-traded company. Experience/Qualifications/Skills: Mr. Shmerling’s business and philanthropic endeavors in the Nashville market provide us with opportunities to create new business relationships and grow market share in this key area. In addition, his 39-year professional history as a licensed CPA (now inactive) in public and private practice provides the board with a broad range of financial knowledge and business acumen. Mr. Shmerling is experienced in assessing and mitigating risk and formulating policies designed to minimize risk exposure. In addition, his experience as an officer and director of publicly-traded companies gives the board another resource for issues specific to publicly-traded companies in the areas of financial reporting and corporate governance. |

| 2021 DIRECTOR COMPENSATION | ||||||||||||||||||||||||||||||||

| Name | Fees Earned or Paid in Cash | Stock Awards | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||||||||||||||

| A | B | C | D | E | F | |||||||||||||||||||||||||||

| Gary D. Butler | $ | 69,750 | $ | 65,201 | $ | — | $ | 1,290 | $ | 136,241 | ||||||||||||||||||||||

| Donald Clark, Jr. | 55,250 | 65,201 | 3,076 | 1,290 | 124,817 | |||||||||||||||||||||||||||

| John M. Creekmore | 87,000 | 65,201 | 26,362 | 11,963 | 190,526 | |||||||||||||||||||||||||||

| Albert J. Dale, III | 85,500 | 65,201 | 930 | 11,219 | 162,850 | |||||||||||||||||||||||||||

| Jill V. Deer | 67,500 | 65,201 | 5,753 | 1,290 | 139,744 | |||||||||||||||||||||||||||

Marshall H. Dickerson(1) | 28,500 | — | — | 4,148 | 32,648 | |||||||||||||||||||||||||||

| Connie L. Engel | 67,500 | 65,201 | — | 1,290 | 133,991 | |||||||||||||||||||||||||||

| John T. Foy | 82,500 | 65,201 | — | 2,034 | 149,735 | |||||||||||||||||||||||||||

R. Rick Hart(1) | 21,375 | — | 1,209 | 675 | 23,259 | |||||||||||||||||||||||||||

| Richard L. Heyer, Jr. | 68,000 | 65,201 | — | 1,290 | 134,491 | |||||||||||||||||||||||||||

| Neal A. Holland, Jr. | 91,250 | 65,201 | — | 15,531 | 171,982 | |||||||||||||||||||||||||||

| Michael D. Shmerling | 70,875 | 65,201 | — | 11,219 | 147,295 | |||||||||||||||||||||||||||

| Sean M. Suggs | 62,250 | 65,201 | 305 | 1,290 | 129,046 | |||||||||||||||||||||||||||

| 2017 Director Compensation | ||||||||||||||||||||

| Name | Fees Earned or Paid in Cash | Stock Awards | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation | Total | |||||||||||||||

| A | B | C | D | E | F | |||||||||||||||

| George H. Booth, II | $ | 42,167 | $ | 35,000 | $ | 3,136 | $ | 5,293 | $ | 85,596 | ||||||||||

| Frank B. Brooks | 57,167 | 35,000 | 2,816 | 7,725 | 102,708 | |||||||||||||||

| Hollis C. Cheek | 54,167 | 35,000 | — | 582 | 89,749 | |||||||||||||||

| Donald Clark, Jr. | 20,500 | 29,167 | — | 134 | 49,801 | |||||||||||||||

| John M. Creekmore | 68,667 | 35,000 | 3,580 | 9,395 | 116,642 | |||||||||||||||

| Albert J. Dale, III | 69,167 | 35,000 | — | 6,376 | 110,543 | |||||||||||||||

| Jill V. Deer | 49,917 | 35,000 | 337 | 582 | 85,836 | |||||||||||||||

| Marshall H. Dickerson | 59,167 | 35,000 | — | 7,725 | 101,892 | |||||||||||||||

| John T. Foy | 57,917 | 35,000 | — | 7,725 | 100,642 | |||||||||||||||

| Richard L. Heyer, Jr. | 45,917 | 35,000 | 2,425 | 582 | 83,924 | |||||||||||||||

| Neal A. Holland, Jr. | 74,292 | 35,000 | — | 582 | 109,874 | |||||||||||||||

| J. Niles McNeel | 46,667 | 35,000 | — | 7,725 | 89,392 | |||||||||||||||

| Hugh S. Potts, Jr. | 41,667 | 35,000 | 532 | 7,725 | 84,924 | |||||||||||||||

| Fred Sharpe | 49,167 | 35,000 | 74 | 582 | 84,823 | |||||||||||||||

| Michael D. Shmerling | 54,667 | 35,000 | — | 7,054 | 96,721 | |||||||||||||||

| EXECUTIVE OFFICERS | ||||||||||||||

| Name | Age | Position | ||||||

| Tracey Morant Adams | 56 | Our Executive Vice President and a Senior Executive Vice President of the Bank since April 2018. Ms. Adams has served as the Bank’s Chief Community Development and Corporate Social Responsibility Officer since November 2016. Ms. Adams served as Senior Vice President of Small Business and Community Development from November 2013 until November 2016. Prior to joining the Bank in November 2013, Ms. Adams was Executive Director of Economic Development for The City of Birmingham, leading economic and community development projects. | ||||||

| James R. “Bo” Baxter, III | 38 | Our and the Bank’s Chief Risk Officer since July 2021. From May 2016 until July 2021, Mr. Baxter served as Executive Vice President and Chief Compliance Officer of the Bank. Prior to joining us and the Bank, Mr. Baxter served as an Examiner with the State of Mississippi’s banking department and and attorney at Balch and Bingham LLP. | ||||||

| Kevin D. Chapman | Our Executive Vice President since January 2011 and Chief | |||||||

| J. Scott Cochran | Our Executive Vice President since April | |||||||

| Kelly W. Hutcheson | 39 | Our and the Bank’s | ||||||

| Mark W. Jeanfreau | Our and the Bank’s General Counsel since January 2020 and our Executive Vice President since September 2017; he has also served as a Senior Executive Vice President of the Bank since September 2017 and as the Chief Governance Officer of the Bank since July 2021. Prior to his assumption of the General Counsel position, Mr. Jeanfreau served as Governance Counsel of the Bank | |||||||

| 64 | Our and the Bank’s Chief Financial Officer since August 2020; he has also served as our Executive Vice President | |||||||

| Name | Age | Position | ||||||

| David L. Meredith | 55 | Our Executive Vice President since | ||||||

| Curtis J. Perry | 59 | Our Executive Vice President and the Bank's Chief Corporate Banking Officer since June 2019. Prior to joining Renasant, Mr. Perry worked in a similar role at Synovus Bank | ||||||

| W. Mark Williams | Our Executive Vice President since July 2011; he has also served as Senior Executive Vice President since July 2014 and Chief Operations Officer since January 2020. Prior to his role as Chief Operations Officer, Mr. Williams served as the Bank’s Chief Banking Systems Officer | |||||||

| COMPENSATION DISCUSSION AND ANALYSIS | ||||||||||||||

| Named Executive | Title | ||||

| E. Robinson McGraw | |||||

| C. Mitchell Waycaster | President and Chief Executive Officer | ||||

| James C. Mabry IV | Chief Financial Officer | ||||

| Kevin D. Chapman | Chief Operating Officer | ||||

| Curtis J. | Executive Vice President | ||||

| 2021 Highlights | ||||||

| Base salaries were not increased (with the exception of an increase for Mr. Perry). | ||||||

| Payouts for performance-based compensation (annual cash awards and equity compensation with a performance cycle ending December 31, 2021) were not adjusted to reflect the impact of the COVID-19 pandemic. | ||||||

| promote retention. | ||||||

•To align our compensation practices with the delivery of shareholder value | •To drive positive operational and performance results using significant performance-based awards | •To provide total compensation that is substantial enough to act as a retention device | ||||||

| FORM | FEATURES | OBJECTIVES | |||||||||

| Fixed Compensation | Base Salary | •Determined annually •Based on individual performance (subject to broader Company goals), internal pay equity and peer group practices at or near the median | •Provides a source of predictable income | ||||||||

| Variable Compensation | |||||||||||

•Annual cash bonus, with the amount contingent on attainment of relative and | |||||||||||

•Aligns pay and | |||||||||||

| Performance-Based Equity Awards | |||||||||||

| Change | 2018 | 2019 | 2020 | ||||||||

| Lengthened Performance Cycles | Performance cycles were increased from one to three years for equity incentives, ensuring that longer-term performance is fully reflected in our compensation decisions | Transition from one-year to three-year cycles completed | |||||||||

| Changed Performance Measures | Performance measures for cash and equity incentives were differentiated, ensuring that compensation decisions reflect a broader range of results | ||||||||||

| Introduced Relative Performance Measures | Performance measures were further differentiated between absolute and relative performance, ensuring that compensation decisions reflect Company performance and performance relative to a peer group | ||||||||||

| Increased Stock Ownership Requirements | Increased stock ownership requirements for our CEO to 500% of base salary | Increased stock ownership requirements for our NEOs (other than our CEO) to 250% of base salary | |||||||||

Renasant Stock Owned(1) | ||||||||||||||

| Mr. Waycaster | 500% of base salary | 677 | % | |||||||||||

| Mr. Mabry | 250% of base salary | 460 | % | |||||||||||

| Mr. McGraw | 250% of | % | ||||||||||||

| Mr. Chapman | 250% of base salary | 526 | % | |||||||||||

| Mr. Perry | 250% of base salary | 262 | % | |||||||||||

| We include shares directly and indirectly owned, including shares subject to time-based restrictions, shares owned by immediate family members and shares owned through our 401(k) and DSU plans; we exclude shares that are pledged or subject to performance measures. | ||||||||||||||

| Equity Retention | |||||||||||||||

| Anti-Hedging and Pledging | |||||||||||||||

| Clawback Policies | Our full board has adopted, and the compensation committee administers, clawback policies that permit us to reduce or recover performance-based compensation if we are required to restate our financial results and the amount of the compensation would be less based on the restatement. The policies address both cash and equity awards. | |||||

| Double Trigger for Change in Control Benefits | The payment of change in control benefits is contingent on a double trigger: if a change in control of the Company is consummated (the first trigger), an executive’s employment must be terminated within two years following the consummation either involuntarily without cause or on account of a constructive termination (the second trigger). Definitions of the terms “cause” and “constructive termination” may be found below in the Compensation Tables section under the heading “Payments and Rights on Termination or Change in Control.” | |||||

| No Tax Gross Ups | The committee does not approve or enter into agreements | |||||

| Timing of Equity Awards | Equity | |||||

| Limits on Performance-Based Payouts | To ensure that total compensation remains at appropriate levels and that performance-based compensation is not excessive, the committee sets maximum payouts that apply regardless of the level of performance. | |||||

| Exercise of Negative Discretion | The committee has the discretion to reduce the amount of any performance-based payout, whether cash or equity, if appropriate, to reflect factors unrelated to Company-wide performance, such as internal pay equity, individual performance, the scope or nature of individual responsibilities or otherwise to ensure that payout levels remain consistent with the purposes of our executive compensation program. | |||||

| Characteristic | Range | Median | Renasant Characteristics | ||||||||||||||

| Total assets | $7.2 billion - $37.7 billion | $16.9 billion | $14.9 billion | ||||||||||||||

| Market value of stock | $816 million - $3.4 billion | $1.8 billion | $1.3 billion | ||||||||||||||

| Net income (loss) | $(360 million) - $307 million | $150 million | $98 million | ||||||||||||||

| Ameris Bancorp | Pinnacle Financial Partners, Inc. | ||||

| Atlantic Union Bankshares Corporation | Seacoast Banking Corporation of Florida | ||||

| BancFirst Corporation | ServisFirst Bankshares, Inc. | ||||

| BancorpSouth Bank | Simmons First National Corporation | ||||

| Bank OZK | SouthSide Bancshares, Inc. | ||||

| Cadence Bancorporation | SouthState Corporation | ||||

| FB Financial Corporation | TowneBank | ||||

| First Financial Bankshares, Inc. | Trustmark Corporation | ||||

| Hilltop Holdings Inc. | United Bankshares, Inc. | ||||

| Home BancShares, Inc. (Conway, AR) | United Community Banks, Inc. | ||||

| Independent Bank Group, Inc. | Veritex Holdings, Inc. | ||||

| Old National Bancorp | WesBanco, Inc. | ||||

| Determining Base Salary Adjustments | Determining Performance-Based Compensation | Determining Other Strategic Compensation | ||||||

•At the end of 2020, Mr. Waycaster recommended that all NEO salaries remain flat in 2021 as compared to 2020 levels, other than Mr. Perry's. •The committee reviewed peer group information provided by Pearl Meyer and Mr. Waycaster’s recommendation and elected to not increase salaries (other than Mr. Perry's). •The recommendations of the committee were approved by the non-employee members of our board of directors. | •At the end of 2020, the committee reviewed possible performance measures and selected the measures described later in this CD&A. •Management recommended possible threshold, target and superior performance levels based on the committee’s direction and Renasant’s 2021 budget. •The committee reviewed performance levels recommended by management and the peer group compensation report provided by Pearl Meyer and (1) set the amount of performance-based compensation for our NEOs; (2) determined the amount payable in Renasant stock and cash; and (3) determined performance measures and individual performance levels for the 2021 fiscal year. •The recommendations of the committee were approved by the non-employee members of our board of directors. •In early 2022, the committee reviewed 2021 fiscal year performance and certified payouts. | •At the end of 2020, the committee recommended time-based stock awards to our board. •The recommendations of the committee were approved by the non-employee members of our board of directors. •At the end of 2021, the committee reviewed the likely outcome of equity incentives vesting at year-end (which were awarded as part of 2019 compensation), the impact of our long-term balance sheet management strategies on the applicable performance metrics and the effect of labor market conditions on retention. •In early 2022, the committee recommended, and the non-employee members of our board of directors approved, an additional retention award for our senior executives other than Messrs. Mabry and Perry. | ||||||

| 2017 BASE SALARY ADJUSTMENTS | |||||||||||

Base Salary (2017) | Base Salary (2016) | % Increase | |||||||||

| Mr. McGraw | $ | 800,000 | $ | 750,000 | 6.67 | % | |||||

| Mr. Chapman | 425,000 | 375,000 | 13.33 | % | |||||||

| Mr. Waycaster | 510,000 | 450,000 | 13.33 | % | |||||||

| Mr. Hart | 508,000 | 496,000 | 2.42 | % | |||||||

| Mr. Cochran | 375,000 | — | — | ||||||||

| 2021 BASE SALARY | ||||||||||||||||||||

| Base Salary (2021) | Base Salary (2020) | |||||||||||||||||||

| Mr. Waycaster | $ | 717,500 | $ | 717,500 | ||||||||||||||||

| Mr. Mabry | 525,000 | 525,000 | ||||||||||||||||||

| Mr. McGraw | 563,750 | 563,750 | ||||||||||||||||||

| Mr. Chapman | 563,750 | 563,750 | ||||||||||||||||||

| Mr. Perry | 461,250 | 435,625 | ||||||||||||||||||

| 2021 POTENTIAL PBRP PAYOUTS AS A PERCENTAGE OF BASE SALARY | |||||||||||

| Threshold | Target | Superior | |||||||||

| Mr. Waycaster | 52.5 | % | 105 | % | 210 | % | |||||

| Mr. Mabry | 37.5 | % | 75 | % | 150 | % | |||||

| Mr. McGraw | 42.5 | % | 85 | % | 170 | % | |||||

| Mr. Chapman | 37.5 | % | 75 | % | 150 | % | |||||

| Mr. Perry | 32.5 | % | 65 | % | 130 | % | |||||

| 2021 COMPANY-WIDE PERFORMANCE MEASURES | ||||||||||||||||||||

| Performance Measure | Weight | Threshold Performance | Target Performance | Superior Performance | 2021 Performance | |||||||||||||||

| Per share | Actual | Relative to Target Performance | ||||||||||||||||||

| Diluted earnings per share (EPS) | 50 | % | $1.95 | $2.05 | $2.15 | $3.12 | 152 | % | ||||||||||||

| Net revenue per share (NRPS) | 20 | % | 10.32 | 10.86 | 11.40 | 11.71 | 108 | % | ||||||||||||

| Peer Percentile | ||||||||||||||||||||

| Return on tangible common equity (ROTCE) | 30 | % | 25th | 50th | 75th | 40th | 80% | |||||||||||||

| PBRP 2021 PAYOUTS | ||||||||||||||

| Mr. Waycaster | Mr. Mabry | Mr. McGraw | Mr. Chapman | Mr. Perry | ||||||||||

| $ | 1,235,535 | $ | 645,750 | $ | 785,868 | $ | 693,413 | $ | 491,272 | |||||

| LTIP PAYOUTS - FOR THE THREE YEAR PERFORMANCE CYCLE ENDING DECEMBER 31, 2021 | ||||||||||||||||||||

| Results | Payouts(1) | |||||||||||||||||||

| Performance Measure | % of Award | 2021 results (percentile) | Award Level | Mr. Waycaster | Mr. McGraw | Mr. Chapman | ||||||||||||||

| ROTCE | 40 | % | 35th | 70% of Target | 3,765 | 3,389 | 2,448 | |||||||||||||

| ROTA | 40 | % | 32nd | 64% of Target | 3,577 | 3,220 | 2,326 | |||||||||||||

| TSR | 20 | % | 51st | 102% of Target | 2,400 | 2,160 | 1,561 | |||||||||||||

| Total | 100 | % | 9,742 | 8,769 | 6,335 | |||||||||||||||

| 2021 Time-Based Awards | |||||||||||

| Executive | Number of Shares | Award Date | Vesting Date | ||||||||

| Mr. Waycaster | 16,528 | January 1, 2021 | January 1, 2024 | ||||||||

| Mr. Mabry | 7,697 | January 1, 2021 | January 1, 2024 | ||||||||

| Mr. McGraw | 16,855 | January 1, 2021 | January 1, 2022 | ||||||||

| Mr. Chapman | 8,427 | January 1, 2021 | January 1, 2024 | ||||||||

| Mr. Perry | 6,795 | January 1, 2021 | January 1, 2024 | ||||||||

| Mr. Perry | 1,875 | March 10, 2021 | March 10, 2024 | ||||||||

| 2017 POTENTIAL PBRP PAYOUTS AS A PERCENTAGE OF BASE SALARY | ||||||

| Threshold | Target | Superior | ||||

| Mr. McGraw | 40 | % | 80 | % | 160 | % |

| Mr. Waycaster | 30 | % | 60 | % | 120 | % |

| Other named executives | 25 | % | 50 | % | 100 | % |

| 2017 COMPANY-WIDE PERFORMANCE MEASURES | ||||||||||

| Performance Measure | Weight | Threshold Performance | Target Performance | Superior Performance | ||||||

| Diluted earnings per share (EPS) | 60% | $ | 2.26 | $ | 2.38 | $ | 2.50 | |||

| Net revenue per share (NRPS) | 40% | 9.88 | 10.40 | 10.92 | ||||||

| 2021 PERFORMANCE MEASURES - THREE-YEAR PERFORMANCE CYCLE ENDING DECEMBER 31, 2023 | ||||||||||||||

| Performance Measure | Weight | Threshold Performance | Target Performance | Superior Performance | ||||||||||

| Peer Percentile | ||||||||||||||

| ROTCE | 40 | % | 25th | 50th | 75th | |||||||||

| ROTA | 40 | % | 25th | 50th | 75th | |||||||||

| TSR | 20 | % | 25th | 50th | 75th | |||||||||

| PBRP 2017 PAYOUTS | |||||||||||

| Performance Measure | % of Award | 2017 Achieved | Mr. McGraw | Mr. Chapman | Mr. Waycaster | ||||||

| EPS | 60% | 101.68% of Target | $ | 523,200 | $ | 171,518 | $ | 250,155 | |||

| NRPS | 40% | 97.98% of Target | 205,500 | 67,368 | 98,255 | ||||||

| Total | 100% | 728,700 | 238,886 | 348,410 | |||||||

| Mr. Hart | Mr. Cochran | ||||||||||

| EPS | 30% | 101.68% of Target | $ | 103,823 | $ | 74,086 | |||||

| NRPS | 20% | 97.98% of Target | 40,779 | 29,099 | |||||||

| Regional Performance | 50% | 44.79% of Target(1) | 56,885 | 133,587 | |||||||

142.49% of Target(2) | |||||||||||

| Total | 100% | 201,487 | 236,772 | ||||||||

| 2021 POTENTIAL LTIP PAYOUTS - THREE-YEAR PERFORMANCE CYCLE | |||||||||||

| Threshold | Target | Superior | |||||||||

| Mr. Waycaster | 11,019 | 16,528 | 24,792 | ||||||||

| Mr. Mabry | 5,131 | 7,697 | 11,546 | ||||||||

| Mr. McGraw | 7,775 | 11,662 | 17,493 | ||||||||

| Mr. Chapman | 5,618 | 8,427 | 12,641 | ||||||||

| Mr. Perry | 4,530 | 6,795 | 10,193 | ||||||||

| Executive | Number of Shares | Award Date | Vesting Date | |||||||||

| Mr. Waycaster | 1,004 | January 25, 2022 | January 1, 2023 | |||||||||

| Mr. McGraw | January 25, 2022 | January 1, | ||||||||||

| Mr. Chapman | January 1, | |||||||||||

| 2017 POTENTIAL LTIP PAYOUTS (NUMBER OF SHARES) | ||||||

| Threshold | Target | Superior | ||||

| Mr. McGraw | 10,000 | 15,000 | 22,500 | |||

| Mr. Waycaster | 3,333 | 5,000 | 7,500 | |||

| Mr. Hart | 5,333 | 8,000 | 12,000 | |||

| Messrs. Chapman and Cochran | 2,667 | 4,000 | 6,000 | |||

| 2017 LTIP PAYOUTS (NUMBER OF SHARES) | ||||||||||||

| Results | Payouts (Number of Shares) | |||||||||||

| Performance Measure | % of Award | Award Level | Mr. McGraw | Mr. Chapman | Mr. Waycaster | Mr. Hart | Mr. Cochran | |||||

| EPS | 60% | 101.68% of Target | 10,632 | 2,835 | 3,544 | 5,671 | 2,835 | |||||

| NRPS | 40% | 97.98% of Target | 5,212 | 1,390 | 1,738 | 2,780 | 1,390 | |||||

| Total | 100% | 15,844 | 4,225 | 5,282 | 8,451 | 4,225 | ||||||

| Albert J. Dale, III, Chairman | ||||||||

| John M. Creekmore | ||||||||

| Richard L. Heyer, Jr., Vice Chairman | ||||||||

| Neal A. Holland, Jr. | ||||||||

| Donald Clark, Jr. | ||||||||

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | ||

| COMPENSATION TABLES | ||||||||||||||